Cheryl Dorsey leads Echoing Green as one of the world’s leading identifiers of social innovators.

Nathan Cummings Foundation has committed 100% of its endowment to mission alignment and has adopted a strategy of impact with the “totality of its assets”. Their 2024 Impact Report shares more about this important work.

Advisee SUPRMARKT opened its doors to the Crenshaw community after accessing capital to acquire real estate and relaunch in a retail format. Keep Slauson Fresh!

Design of an equity-lens loan fund program focused on working capital needs for local microenterprises and the informal economy.

IMPACT FUND ADVISING, DEVELOPMENT, & MANAGEMENT

Relevant capital must be structured to meet the needs of those it intends to help. When funds are seeking to accomplish social, environmental, or other strategic goals alongside financial return, that structuring can become quite challenging. Often a lead investment of catalytic capital is necessary to unlock additional capital. Once created, strategic funds can struggle to successfully deploy capital and realize projected returns or impact. Pipeline development and credible due diligence are essential to execution.

We are proud to have worked on a variety of endeavors, including some we cannot disclose, such as:

FUND MANAGEMENT & OVERSIGHT

Management of the Echoing Green Signal Fund, a $40 million catalytic capital fund making direct deployments into the world’s leading social innovators. In addition to fund management, integration of significant programmatic supports for founders including capital readiness, mentorship, and technical assistance fundings.

Management of the Angel City Seed Fund, an internal pool of capital deploying direct investments into early-stage social enterprises and community voices in Greater Los Angeles and beyond. The Seed Fund is comprised of two vehicles: an investment fund that accepts outside LP investments, and a donor-advised fund that accepts philanthropic investments.

Board and Investment Committee oversight of the Nathan Cummings Foundation, one of few philanthropies to commit 100% of its endowment to mission-alignment and retain BIPOC managers as OCIO.

Investment Committee oversight of the Fair Food Fund, a national food enterprise investor deploying catalytic capital and wrap-around business services.

Selection as portfolio manager by Los Angeles County Department of Opportunity to service over 200 loans made to small businesses by various public agencies.

FUND DESIGN & STRUCTURING

Design of the Echoing Green Signal Fund as a model for founder-first deployments of catalytic capital to bridge social innovators through the Valley of Death.

Design of the Nathan Cummings PRI Program as a mission-aligned investment program that exists within the investment corpus, not as a carve-out from grantmaking budgets.

Design of the Michigan Good Food Fund (Fund II) model with a significant pivot towards community governance, racial equity targets, and a multi-lender platform targeting $40 million in deployments supported by credit enhancements and enterprise advisory resources.

The design and deployment of California FreshWorks (Fund I & Fund II), alongside knowledgeable partners, likely still the largest private healthy food financing vehicle of its kind. The third iteration of FreshWorks is underdevelopment and has recently been awarded a $3 million seed award.

Design of a prototype film fund for the Marguerite Casey Foundation to help resource creators of color and launch emerging writers, directors, and producers that drive narrative change and portray the future we hope to see.

Design and Implementation Plan for the Los Angeles County Microloan Program that uses balance sheet equity, technical assistance subsidy, and loan guarantees to bring capital to the informal economy, re-entry populations, and microentrepreneurs who are unsupported by traditional banking, government, and philanthropic loan programs.

Investment DUE DILIGENCE

Financial, sectoral, and operational due diligence of social enterprise Everytable alongside fund-level diligence of the Social Equity Franchise program’s $25 million financing arm for a potential syndicate of CDFIs and debt investors alongside a catalytic capital guarantor.

Due diligence of a broadcasting and media production company and companion film fund vehicle seeking investment capital to finance independent projects from rising creatives.

Due diligence of two technology companies seeking seed stage investment for models seeking to reduce incarceration and accelerate re-entry into employment, housing and credit post-incarceration.

The design, manager due diligence, and ongoing monitoring of the Los Angeles Bioscience Investment Fund, which attracts high-risk capital to place as venture investments into early-stage life science companies as part of a regional economic development strategy.

Demand assessment and advising on the Catalytic Development Fund, which intends to invest in public and private real assets as a catalyst for redevelopment in Los Angeles County.

Due diligence across a number of unique and complex transactions, such as the acquisition of a large portfolio of distressed housing assets by a regional nonprofit to divest them from an absentee private equity player and bring them into the inventory of affordable housing units in an overheated market.

Community resident Board of the Project New Village working to strengthen the local food chain. RIP Tambusi

LACI is one of the nation’s leading incubators of climate tech innovations.

Financial advising for North Flint Food Market, a startup grocery based on cooperative economics.

Enterprise Consulting & Mentorship

A brilliant idea rarely survives alone. Successful entrepreneurs and leaders, especially those hailing from nontraditional networks or disinvested communities, require support and mentorship to grow and evolve. Community-generated ideas often have the authenticity and knowledge to solve big problems. But leaders may not be experienced in how to launch or scale a business. And investors may not listen well. Social entrepreneurship requires investment beyond capital.

We are proud to have advised and assisted, in many small ways, a portfolio of inspiring leaders and networks, such as:

Strategic advisory relationship with the Gonzalez family of Northgate Markets, a 40+ chain of independent supermarkets that bring healthy and high-quality foods to Latinx communities at working-class prices. Supported financings of over 200,000 square feet of new grocery space in five low-income communities.

Advisory and Board Oversight of the Los Angeles Cleantech Incubator, committed to an inclusive green economy by unlocking innovation, transforming markets, and enhancing communities.

Project New Village, a resident-led, community-rooted movement in Southeastern San Diego seeking to acquire land, build a multi-use commercial food hub that strengthens the Mt. Hope neighborhood and its local food supply chain while addressing social inequities.

Village Market Place at the Paul Robeson Center, a food oasis and social justice movement in the heart of South Los Angeles.

The North Flint Food Market, a cooperative grocery seeking to revitalize its community and address the water crisis by bringing jobs and fresh produce to their neighborhood through land acquisition and food sovereignty investments.

The Brittingham Social Enterprise Lab, an academic center at the USC Marshall School of Business, where college students are prepared to create and launch new enterprises.

A portfolio of community-based projects, mostly involving the intersection of commercial redevelopment and new enterprise launch, seeking access to tax credit or other public finance programs and catalytic capital. We are proud to have produced the business plan for the Detroit People’s Food Coop, which will be launching as part of the Detroit Food Commons in 2024.

Financial consulting for individuals, startups, and nonprofits seeking to increase their capacity for financial structuring or to improve their financial controls.

The first cable-stay river bridge in Los Angeles. Awarded 2021 Bridge Project of the Year by the American Society of Civil Engineers (LA Section).

Accessory dwelling unit (ADU) construction in the Crenshaw District.

Biddy Mason was one of Los Angeles’ first real estate moguls. A new South Central LA affordable housing project will bear her name.

Real Estate Advising & Project Management

Be the change you wish to see. This personal adage applies to the built environment around us, which in turn can determine how healthy and inspiring a community can be. Real estate development need not occur simply for the sake of financial return. It can be a powerful tool to create the places that we want to live, work, and play for the next century.

We are proud to have contributed, across a variety of roles, in a number of important and community-oriented real estate projects, such as:

On-call Financial Advisor for LA METRO’s Joint Development Unit in support of an updated Policy to build as much affordable housing near transit as soon as possible – meaning a target of 10,000 units in ten years across a broad set of Metro-owned properties adjacent to transit lines.

Pre-development support of the Biddy Mason, a South Central LA affordable housing project driven by local community members taking back their block.

Redevelopment of the Los Angeles River corridor, including conversion of older industrial facilities into cleaner and modern uses; as well as jumpstarting construction of the first cable-stay river bridge in Los Angeles.

Renovation and re-occupancy of a blighted and vacant 19-story tower in a small midwestern town as the cornerstone of a main street revitalization strategy.

Exploration of new community-owned real estate models such as neighborhood REITS, Community Investment Trusts, and other structures as part of a national community of practice.

Design, entitlement, and activation of underutilized industrial and commercial buildings to support emerging creative and tech enterprises as well as workforce housing.

Development of Accessory Dwelling Units in single-family districts as a means of responsibly increasing density and providing low-impact housing.

Advising on the disposition of a portfolio of troubled assets acquired and developed as part of a philanthropically-motivated urban core redevelopment strategy.

“The thesis is credible, that good food makes healthy communities, but stakeholders must continue to invest and study in order to validate our social impact.” - Daniel Tellalian, founding member, LAFPC leadership circle

2020 Food System Dashboard, Los Angeles Food Policy Council

Community Capacity Building & Ecosystem Development

Even if a community is seeking strategic investment, it must be prepared to attract and receive that investment. The infrastructure, leadership, and opportunities must have coalesced into a compelling investment offer for outsiders. And guardrails must be established to channel market forces to accomplish policy. The evolution of a place, be it a corner, neighborhood or region, to ready it for investment requires intentional and thoughtful preparation.

We are proud to have contributed to a number of well-regarded place-based initiatives that utilize community engagement and collective impact strategies to engage market forces, including:

The design and execution of an ecosystem development strategy intended to amplify and coalesce the bioscience cluster in Greater Los Angeles, including the founding, capitalization, and launch of a nonprofit with the sole purpose of cultivating that ecosystem.

Exploration and design of “social innovation hubs” as ecosystems that recognize, cultivate, and accelerate community voices and social entrepreneurs to launch and scale social change strategies. This includes the publication of Social Innovation directory for Greater Los Angeles as an open source for funders, founders, investors, and community champions to find one another.

The design and execution of a portfolio of multi-year place-based strategies in low-income communities across the nation, in coordination with place-based economic development investors including large corporations, private philanthropies, and public municipalities.

Community engagement and partnership-building associated with specific investments and commercial activity, such as the launch of a new bank branch or supermarket in a disinvested community.

Research, Strategy, & Thought Leadership

Our primary efforts are as practitioners. However, we have been asked to speak, write, and advise as subject-matter experts across a number of topics. We believe that those engaged in a particular sector or arena will know us without having to call out a laundry-list of public-facing activities.

A few products or roles that we are particularly proud of include:

During Mission Investors Exchange’s inaugural convening in Los Angeles in 2024, honored to curate four Day One “Impact in Action” site visits for the record-breaking number of attendees. Introduced national audience to LA gems like the Community Coalition, LA Cleantech Incubator, Everytable, and Slauson & Co. and the corresponding impact investment opportunities they present. Daniel also had a chance to make the case why Los Angeles is an emerging social innovation ecosystem for trade periodical Impact Entrepreneur.

A community engagement project, Grand River Voices, for the Greater Grand Rapids and Kent County community. It captured and presented community voice regarding the Grand River and who can benefit from it. Our team was active at public events, at community workshops, and online.

Our substantial market research and socialization of nontraditional metrics to evaluate the economic power of low-income and immigrant communities that are consistently under-measured by the U.S. Census and traditional algorithmic estimates of purchasing power.

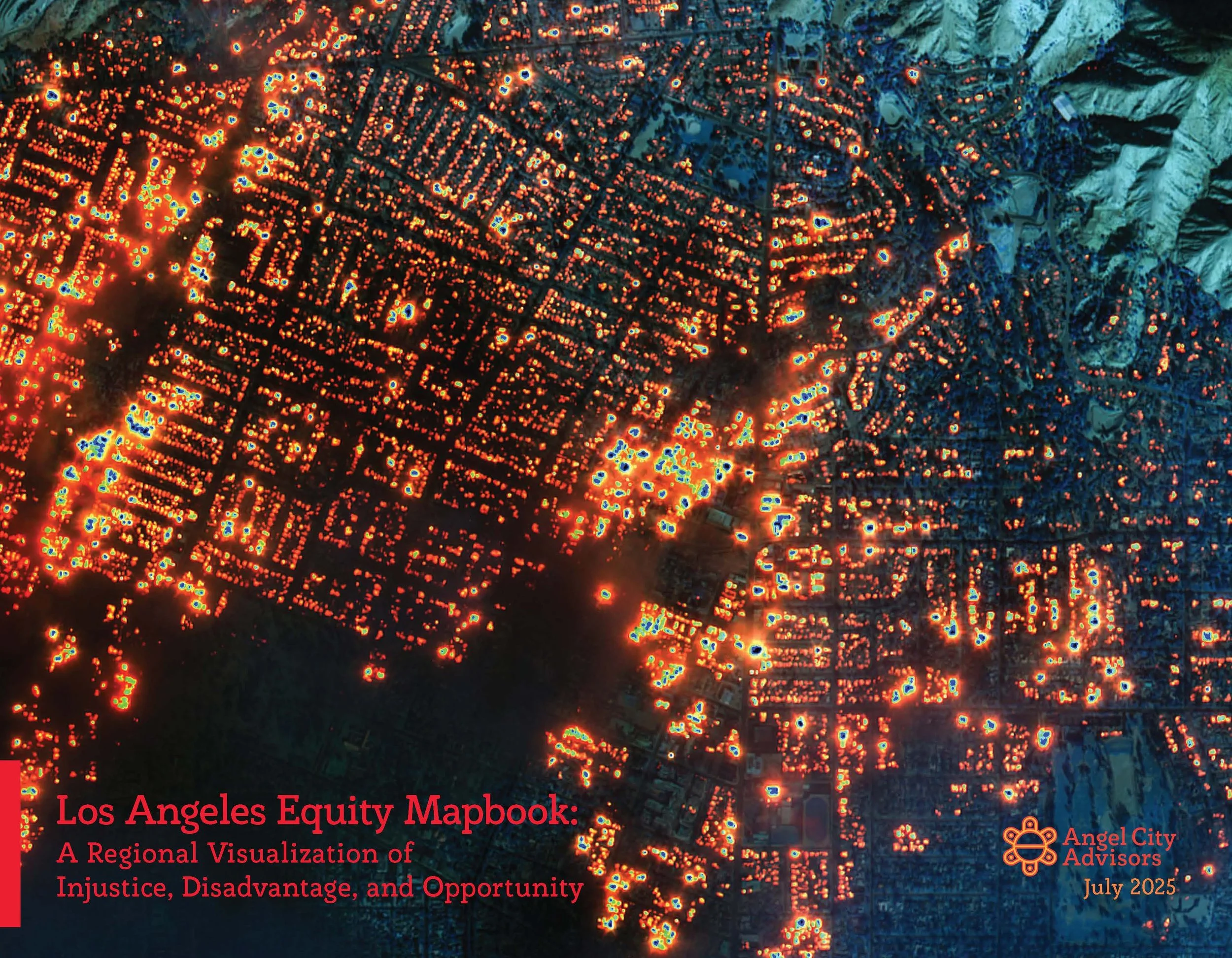

Publication of a Los Angeles Equity Mapbook, in response to the civil uprising of 2020, visualizing injustice and exclusion in a portfolio of 79 maps for use by activists, policymakers, and investors. A data update is in the works.

A publication by the Federal Reserve Board entitled Place Matters that helped spur greater place-based investing by regulated financial institutions.

A pair of publications by the Pew Charitable Trusts entitled Unbanked by Choice and Slipping Behind that culled and presented insights about the financial behaviors of low-income individuals from a massive longitudinal study of Los Angeles residents, which was part of the case for the establishment of the Consumer Financial Protection Bureau.

Participation in advisory boards for Nielsen, to help improve its statistical measurements of communities of color and the Los Angeles Food Policy Council, guiding the creation of a local and equitable food system.